How to Build an Emergency Fund: A Simple Step-by-Step Plan for Financial Peace

- Dec 06 2025

Smeera Enterprise

Smeera Enterprise

How to Build an Emergency Fund: A Simple Step-by-Step Plan for Financial Peace

Ever wonder how an emergency fund plays out in the real world? Fast-forward to 2025, where economic shifts, tech glitches, and unexpected twists make financial surprises more common than ever. Inflation’s still lingering, AI is reshaping jobs, and global events like climate changes are hitting wallets hard. But don’t panic—having that safety net can turn “oh no” moments into “I’ve got this.” In this post, we’ll dive into 5 relatable, real-life scenarios based on 2025 trends (drawn from experts like the World Economic Forum and financial forecasts). I’ll keep it simple, fun, and actionable, with tips on how your emergency savings steps in as the hero. Let’s break it down with stories that feel like they could happen to anyone.

Scenario 1: The Tech Job Layoff Wave – When AI Takes Over

Picture this: You’re a marketing whiz at a mid-sized firm, but in 2025, AI tools like ChatGPT upgrades are automating your role. Boom—layoff notice hits. With unemployment hovering at 5-7% (per Fed projections), finding a new gig might take 3-6 months. Without an emergency fund, you’d scramble for loans or dip into retirement savings, adding stress.

How Your Fund Helps: That 3-6 months’ buffer covers rent, groceries, and job search costs (think resume services or networking events). Pro Tip: Use the time to upskill in AI-human collaboration—free courses on Coursera can turn this into a comeback story.45

Scenario 2: Climate Chaos Hits Home – Natural Disasters on the Rise

By 2025, extreme weather events are up 20% (thanks to climate reports), and your coastal home gets flooded from a mega-storm. Insurance might cover some, but deductibles, temporary housing, and repairs could cost $10,000+. If you’re in a high-risk area, this isn’t “if”—it’s “when.”

How Your Fund Helps: Pull from your emergency savings for immediate needs, like hotel stays or emergency repairs, while insurance sorts out the rest. Fun Fact: Apps like FEMA’s disaster aid trackers can help you claim funds faster—your fund buys you breathing room to navigate the chaos.

Scenario 3: Health Scare Surprise – Medical Bills Spike Amid Inflation

Healthcare costs are ballooning in 2025, with average premiums up 8% (per Kaiser Family Foundation). Say you twist an ankle playing weekend soccer—ER visit + follow-ups = $5,000 out-of-pocket. Or a family member needs unexpected surgery. High-deductible plans mean you’re on the hook.

How Your Fund Helps: Cover the gap without maxing credit cards or delaying care. In a pinch, it prevents debt spirals. Bonus: Pair it with a Health Savings Account (HSA) for tax perks—double win for your wallet.

Scenario 4: Supply Chain Shenanigans – Everyday Costs Explode

Global trade hiccups from geopolitical tensions (think U.S.-China relations) mean car parts or electronics shortages in 2025. Your car’s transmission fails, and repairs cost 30% more due to delayed imports. Or your fridge dies, and appliances are backordered for months.

How Your Fund Helps: Fund the repair or rental while waiting, avoiding interest on loans. It’s like having a “pause button” on life’s annoyances. Tip: Build your fund with inflation in mind—aim for 4-5% growth in a high-yield account to outpace rising prices.

Scenario 5: Family Life Curveballs – Kids, Weddings, and Unexpected Joy (or Drama)

2025’s family dynamics are evolving: Remote work means more relos, or a surprise wedding for your sibling. But what if a kid’s college fund needs a boost, or a pet emergency vet bill pops up? These “happy” events can strain budgets unexpectedly.

How Your Fund Helps: Handle the extras without derailing your plans. For example, cover a short-term gap in childcare during a move. Remember, it’s not just for disasters—it’s for life’s adventures too!

Why 2025 Makes an Emergency Fund Even More Crucial

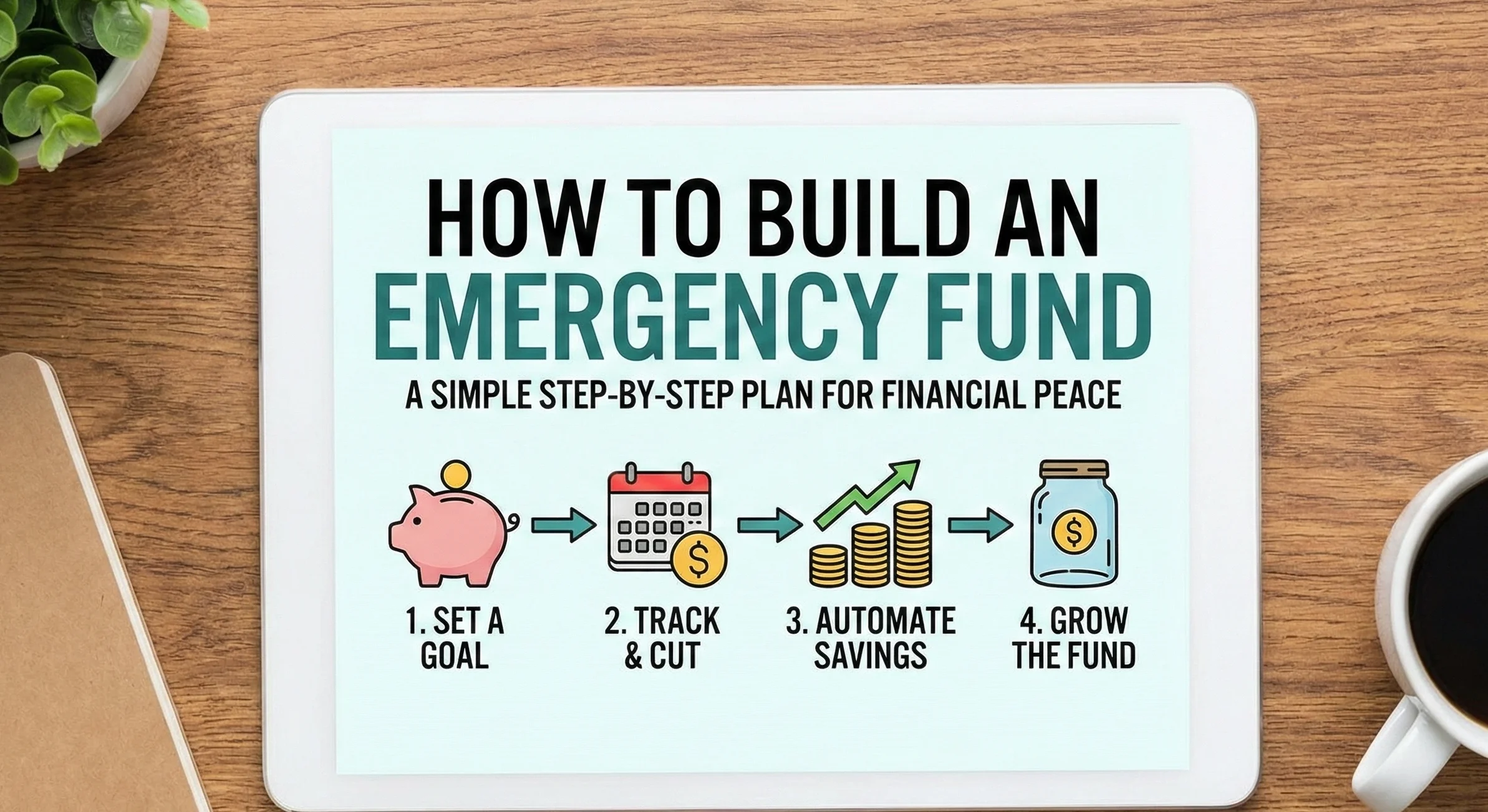

With economic uncertainty (recessions possible, per IMF), job volatility from AI, and rising costs, experts say 70% of Americans are underprepared for emergencies. But building one now sets you up for 2025’s twists. Start small: Automate $100/month, cut one subscription, and watch it grow. It’s not boring—it’s empowering.

Final Thought: Life in 2025 will throw surprises, but your emergency fund is your secret weapon. Ready to build yours? Check out our step-by-step guide and share your 2025 worries in the comments—we’ll brainstorm solutions!

Disclaimer: These scenarios are speculative based on 2024 trends; actual events may vary. Consult a financial advisor for personalized advice.